georgia ad valorem tax trade in

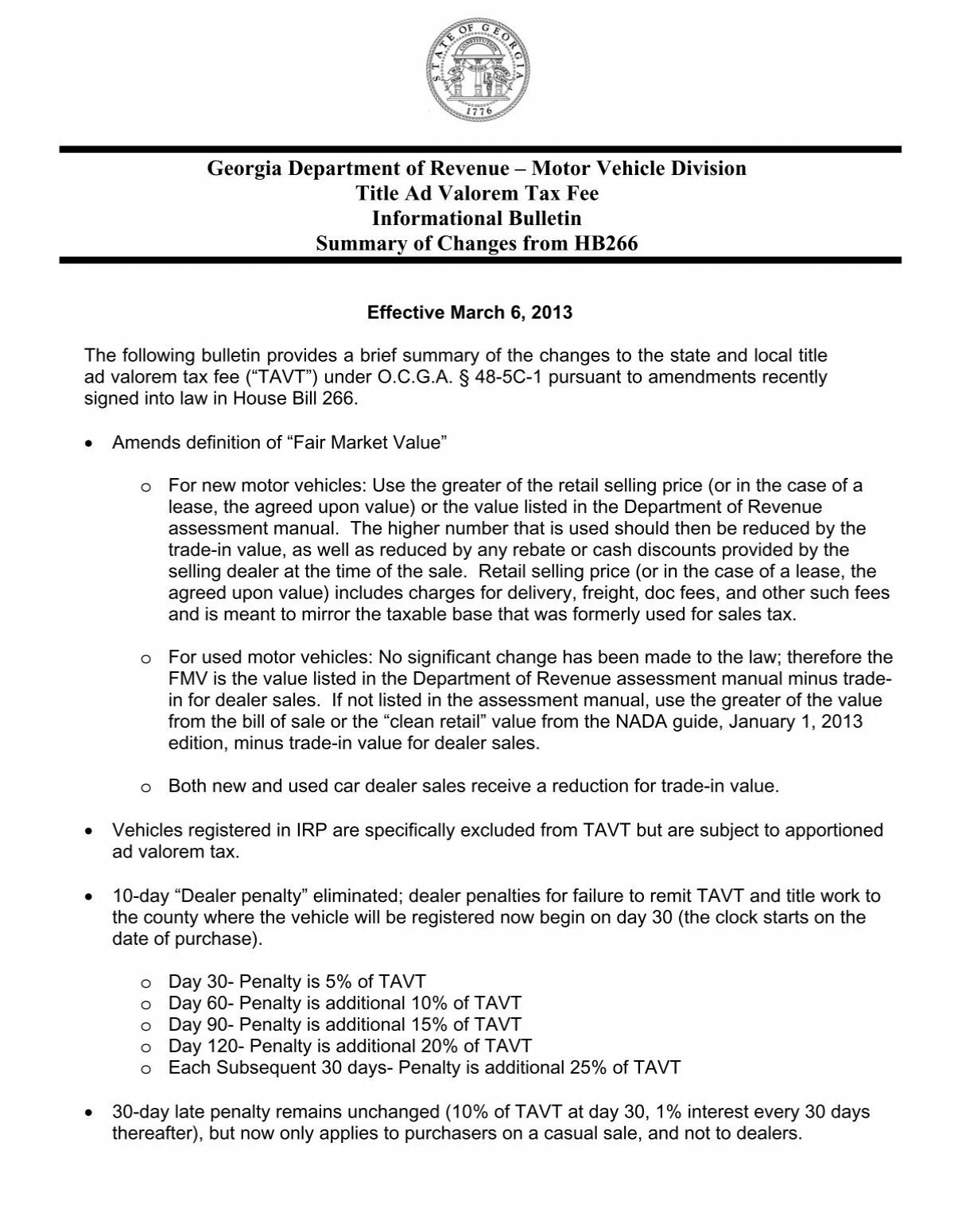

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Justia Free Databases of US Laws Codes Statutes.

Justia Free Databases of US Laws Codes Statutes.

. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later. This one-time fee is based on the value of the car not the. February a 1 discount.

The form and certification for your military annual ad. If the sale included a trade-in the FMV is first reduced by that amount before multiplying by the. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

2021 Georgia Code Title 48 - Revenue and Taxation Chapter 8 - Sales and Use Taxes Article 2 - Joint County and Municipal Sales and Use. The trade-in value of another motor vehicle will be deducted from the value to get the taxable value. Georgia HB997 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax.

DOWNLOAD CURRENT TAVT ASSESSMENT MANUAL TITLE AD VALOREM TAX CALCULATOR. The ad valorem tax is a type of taxation based on a commoditys assessed value like real estate or personal property. This calculator can estimate the tax due when you buy a vehicle.

Those who are stationed in Georgia may be eligible for an exemption from the Ad Valorem Tax if they are in the military. How much is the car sales tax rate in Georgia. How to Calculate Georgia Tax on a Car.

Georgia does not charge a state sales tax on new or used cars. You can calculate the Title Ad Valorem Tax by finding the fair market value of the vehicle and multiplying it by 66. If I itemize deductions on Federal Schedule A can I deduct my auto registration and.

Everyone who owns a vehicle licensed in Georgia must. If an owner believes the value is too high for the condition of their vehicle they may appeal the value to the County. Pay Taxes Property Taxes.

As of 2018 residents in most Georgia counties pay a one. As of 2018 residents in most Georgia counties pay a one. January a 2 discount.

Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value shown by the. Property Taxes are payable in November with a 4 discount. They do however charge a 66 title ad valorem tax TAVT.

The aggregate amount of penalties imposed pursuant to this subsection shall not exceed an amount equal to 20 percent of the principal amount of the tax originally due. The gross amount is. What if I think that the title ad valorem tax assigned to my vehicle is too high.

2021 Georgia Code Title 12 - Conservation and Natural Resources Chapter 8 - Waste Management Article 1 - General Provisions 12-8-1. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later.

Gwinnetttaxcommissioner Motor Vehicle General Titling Register My Vehicle If I M New To Georgia

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

Tax Commissioner Lowndes County Ga Official Website

![]()

Can The Trade In Value Of The Car Be Used To Reduce Title Ad Valorem Tax Tavt Amount In Georgia Car Forums At Edmunds Com

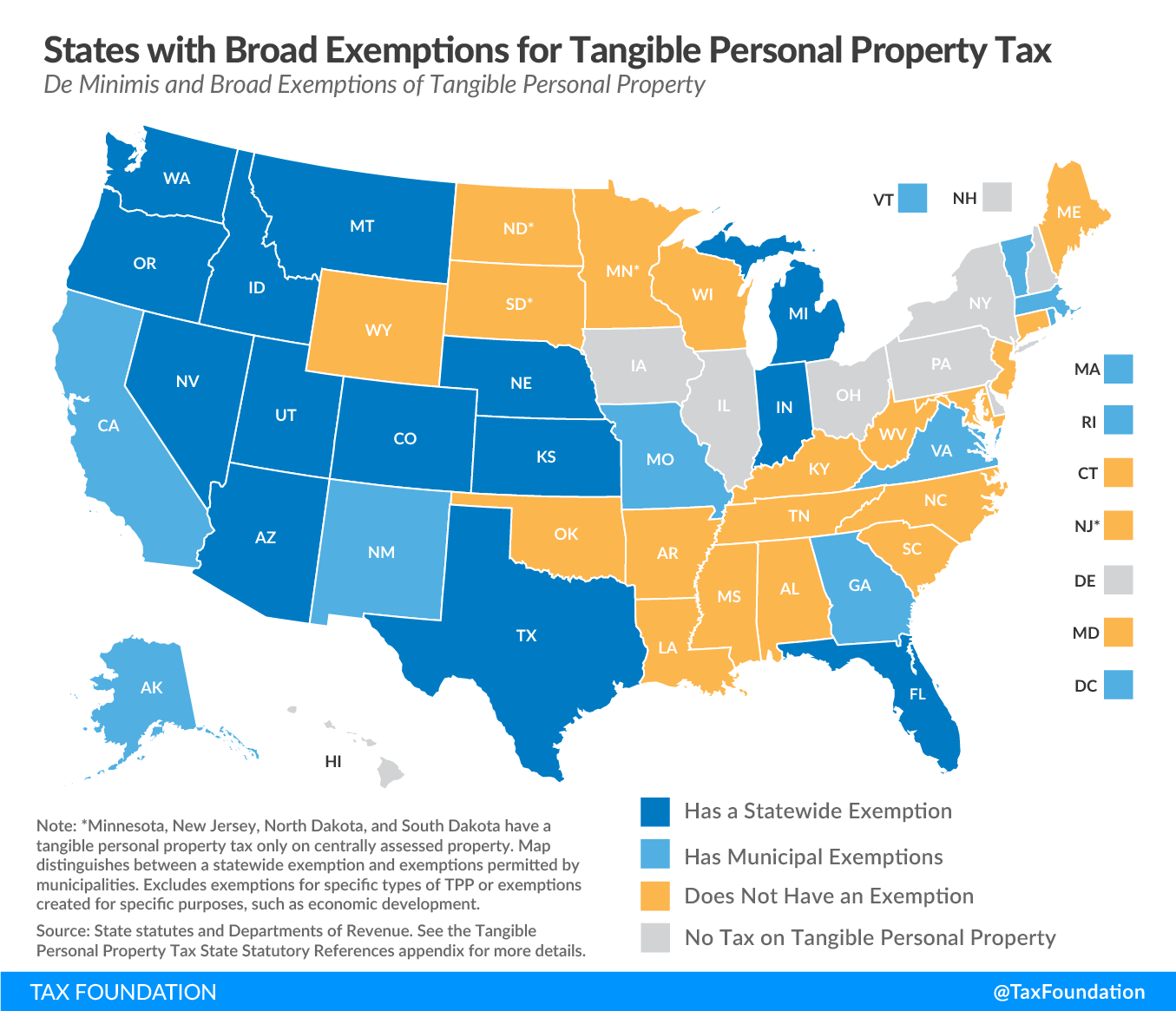

State Property Taxes Reliance On Property Taxes By State

Auto Dealers Can Manipulate Car Prices Through Tavt Local News Valdostadailytimes Com

Updates To Georgia Lease Tax Canton Ga Serving Alpharetta And Atlanta

Tax Commissioner S Office Cherokee County Georgia

Property Taxes By County Interactive Map Tax Foundation

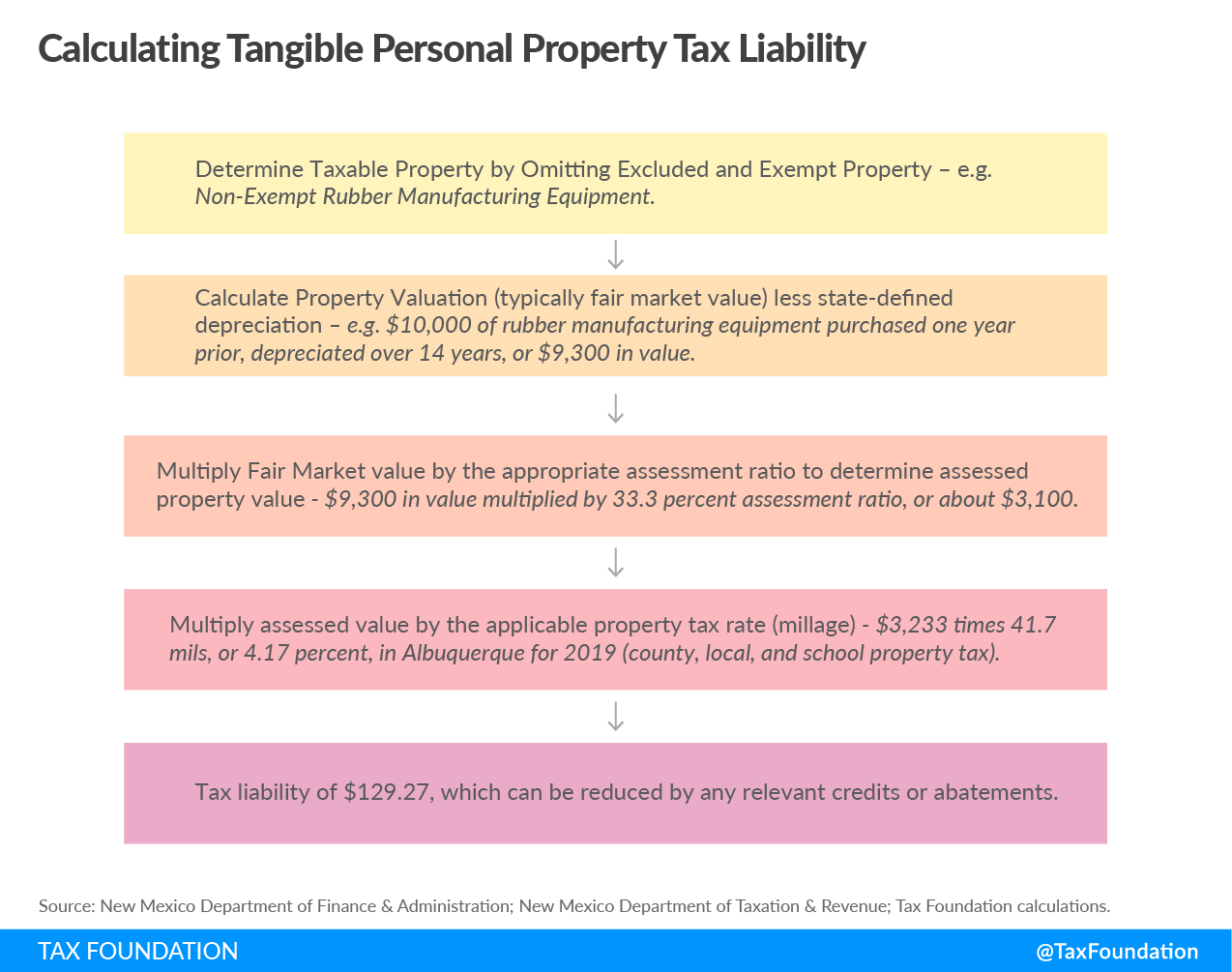

Tangible Personal Property State Tangible Personal Property Taxes

Sales Taxes In The United States Wikipedia

Sales Tax Laws By State Ultimate Guide For Business Owners

Tangible Personal Property State Tangible Personal Property Taxes

Sales Taxes In The United States Wikipedia

Tangible Personal Property State Tangible Personal Property Taxes