do you pay taxes on inheritance in colorado

Only a handful of states have such. Do I have to pay ta on an inheritance in the state of Colorado.

It S Weekend Yaay Time To Take Stock And Be Thankful For The Past Week Have A Lovely One Accounting And Finance Academy The Past

There is no inheritance tax or estate tax in colorado.

. When it comes to. All Major Categories Covered. The State of Florida does not have an inheritance tax or an estate tax.

The beneficiary who receives the. There is no estate or inheritance tax collected by the state. The first rule is simple.

A state inheritance tax was enacted in Colorado in 1927. Although there is no federal tax on it inheritance is taxable in 6 states within the US. Yet some estates may have to pay a federal estate tax.

Thats because federal law doesnt charge any inheritance taxes on the heir directly. 2 days agoThe money 750 for individual filers and 1500 for joint filers comes from taxes collected by the state that exceed TABOR limits. How much tax do you pay on inheritance.

This is because its typically not considered taxable income at the federal level. Generally you do not have to report Colorado inheritance tax to the IRS. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

The good news is that since 1980. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. However Colorado residents still need to understand federal estate tax laws.

Colorado Form 105 Colorado Fiduciary Income Tax Return is the Colorado form for estate income taxes. No the IRS does not impose taxes on foreign inheritance or gifts if the recipient is a US. If you receive property in an inheritance you wont owe any federal tax.

As of June 2022 you may have to pay inheritance tax on assets if your decedent lived in one of the following six states. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Inheritance taxes are different.

If it is the deceaseds share of the asset you held in joint tenancy is subject to tax just like the rest of her estate. Until 2005 a tax credit was allowed for federal estate. Inheritance tax is a tax paid by a beneficiary after receiving inheritance.

Fisher Investments has 40 years of helping thousands of investors and their families. However estate assets may. Do I have to pay taxes on a 10 000 inheritance.

This really depends on the individual. The tax in these states ranges from 0 to 18. Additionally if you are married to the person who.

Yet some estates may have to pay a federal estate tax. The federal government doesnt charge. Select Popular Legal Forms Packages of Any Category.

How much tax do you pay on inheritance. TABOR refunds happen every time the state. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

For example if you only inherited 10000 you may be exempt and not have to pay a tax. You never have to pay the tax but it could take a bite out of your inheritance. However if you receive an.

There is no federal inheritance tax but there are a handful of states that impose state level inheritance taxes. Citizen or resident alien. Again Colorado is not one of the states.

They may have related taxes to pay for example if. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. Although the IRS will not tax the actual inheritance you will still.

In some states a person who receives an inheritance might have to pay a tax based on the amount he or she has received. We are both on Social Security so not alot - Answered by a verified Tax Professional. Since Colorado does not impose either inheritance or estate taxes on the state level most of the Centennial States residents dont have to worry about the financial burden when they become.

How much money can you inherit without paying taxes on it. While federal estate taxes and state-level estate or inheritance taxes may apply to estates that exceed the applicable thresholds. If your loved one passed way after July 1.

Estate Planning Estate Planning Estate Planning Checklist How To Plan

Don T Forget The 65 Day Rule March Deadline As An Opportunity For Tax Savings Preservation Family Wealth Protection Planning

Death In The Family Turbotax Tax Tips Videos

Got A Will Here Are 11 More End Of Life Documents You May Need

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Estate Planning Estate Planning Estate Planning Checklist How To Plan

Inheriting Real Estate In Colorado

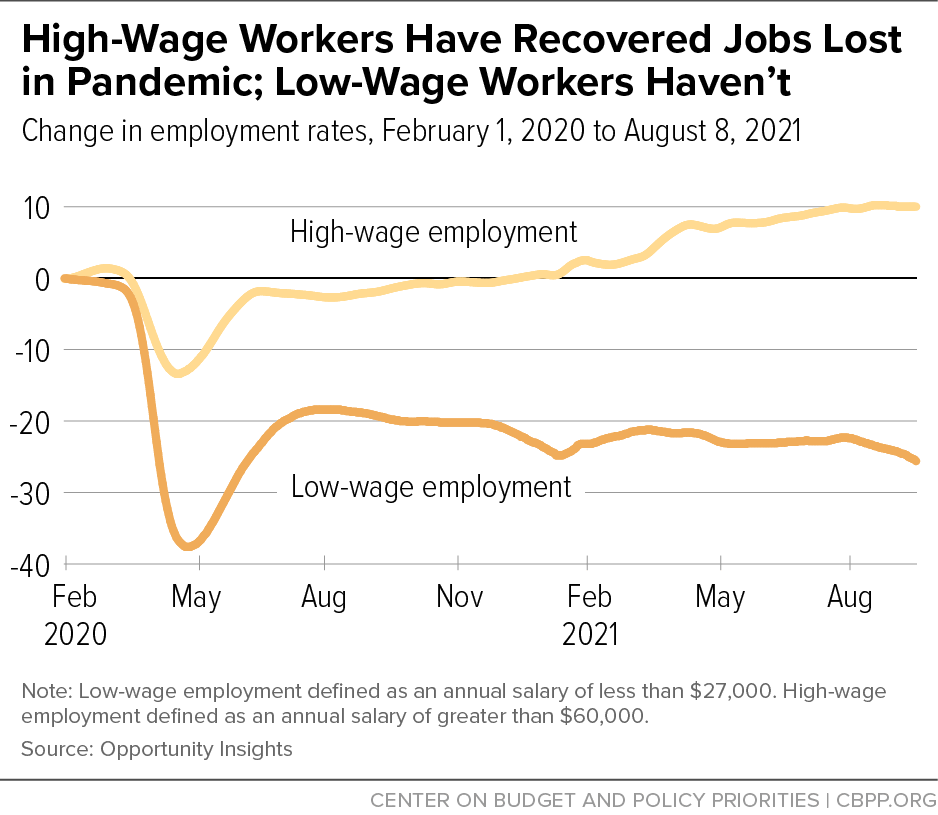

States Enacting Wealth Taxes To Support Pandemic Recovery Improve Equity Center On Budget And Policy Priorities

We All Need Plans To Minimize State And Federal Estate Taxes And These Plans Are Best Structured By A Profession Estate Tax Estate Planning Financial Services

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Estate Planning Estate Planning Estate Planning Checklist How To Plan

Vintage Ted Degrazia Angel Roadrunner Wall Hanging Etsy Art Painting Artwork

States Enacting Wealth Taxes To Support Pandemic Recovery Improve Equity Center On Budget And Policy Priorities